I have a Fixed deposit (FD) in Paytm Payments Bank, which has a collaboration with IndusInd Bank for maintaining FD’s. My FD has a maturity date of June 5th, 2025.. and that’s when something strange happened.

The Moment Everything Fell Apart

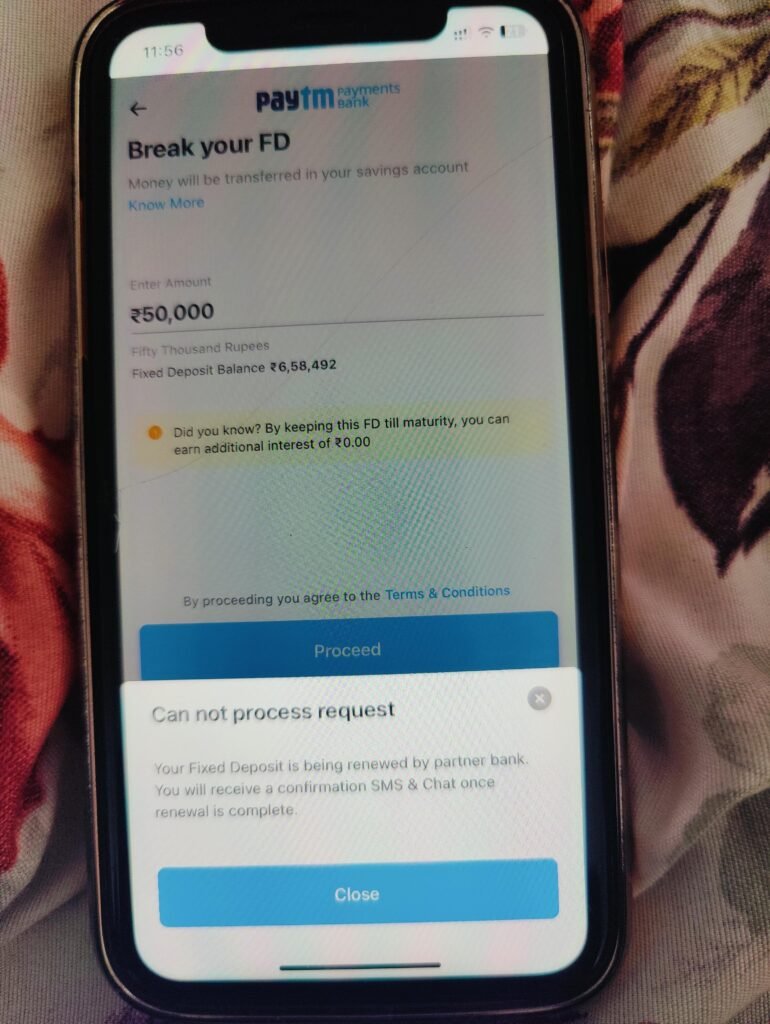

On 5th June 2025, I urgently needed ₹7.1 lakh from my Fixed Deposit—money that would cover a family emergency. With a racing heart, I opened the Paytm app, tapped “Break FD”, and was met with this cold, infuriating message:

“Your Fixed Deposit is being renewed by partner bank. You will receive a confirmation SMS & chat once renewal is complete.”

That single popup plunged me into an agonizing, month‑long maze of empty promises and blame shifting.

Day 1–10: The Deafening Silence

- Raised Service Requests with both Paytm Payments Bank (Case Id – 3389797746) and IndusInd Bank (Case Id: 74487326 & 75153547) —only “we’ll look into it” replies.

- No timeline. No updates. Just generic acknowledgments.

- Visited Nearby IndusInd Bank Branch – No one could help me a bit.

Every passing hour meant mounting anxiety: medical bills, urgent travel plans, rents, & fees—nothing could wait.

Day 11–20: Regulatory Run‑Around

- RBI Ombudsman Complaint:

- Filed on 16th June.

- Closed in 48 hours under Clause 10(2)(b)(i) as —even though I had never complained to RBI before.

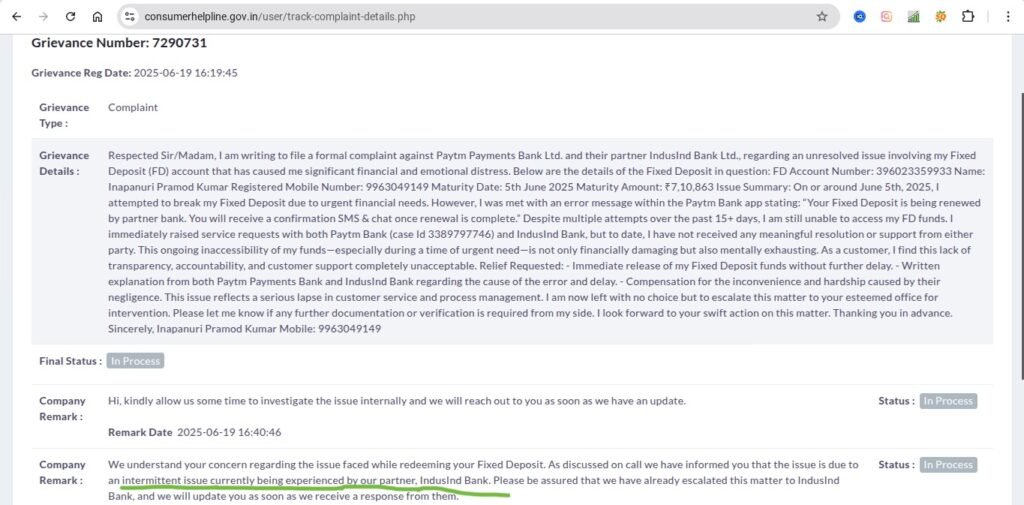

- National Consumer Helpline:

- Escalated to the Ministry of Consumer Affairs.Paytm Bank’s official response in the complaint (screenshot below): “This is due to an intermittent issue with our partner, IndusInd Bank. We have escalated to them.”

But when I confronted IndusInd Bank with Paytm’s admission, their customer‑care rep flat‑out denied any glitch on their end.

Day 21–30+: The Desperate Fightback

- Emails to Principal Nodal Officers of both banks:

- Demanded written proof of any “intermittent issue.”

- Asked for resolution timelines—crickets in reply.

- Fresh RBI Filing:

- Explicitly stated “This is my first RBI complaint on this FD” and attached my entire paper trail.

- Consumer Forum Notice:

- Drafted to seek ₹7.1 lakh + damages for “deficiency in service.”

And still—no money, no answers, no accountability.

Why You Should Care

- Real Money, Real Emergencies: Banks talk about “liquidity” on paper—but when systems fail, your life grinds to a halt.

- Collaboration Confusion: Paytm Bank blames IndusInd. IndusInd blames— Paytm bank. You’re stuck in the middle.

- Regulatory Loopholes: RBI’s Clause 10 lets banks dodge merits‑based review, shutting the door on appeals.

My Call to Arms

I refuse to let this ordeal fade into the void. Here’s how you can help:

- Share this post on Facebook, Twitter, LinkedIn—everywhere.

- Tag @paytmbankcare and @MyIndusIndBank.

- Demand answers: Why was my FD locked? When will my ₹7.1 lakh be released?

- Alert consumer‑rights groups and financial bloggers to spotlight this injustice.

Banks respond to pressure. If enough of us shine a light on this failure, we’ll force them to fix it—fast.

“When our hard‑earned money is held hostage by a tech glitch and a blame game, it’s not just a banking failure—it’s a breach of trust.”

Let’s make some noise. Let’s make the banks act. And let’s ensure no one else ever faces this digital nightmare.

Have your own locked‑FD horror story? Drop it in the comments. Together, we can turn outrage into action.